For example, seasoned traders might opt for a low-risk scalping strategy while beginners might find this strategy complex. Several forex traders prefer intraday trading because of the market volatility which offers more opportunities in narrower timeframes. However, forex weekly trading strategies are more flexible and stable.

Natural Gas Forecast: Market Stability Prompts Consideration of … – DailyForex.com

Natural Gas Forecast: Market Stability Prompts Consideration of ….

Posted: Wed, 13 Sep 2023 13:48:00 GMT [source]

It runs from 0 to with anything above 70 indicating that the pair is overbought. Furthermore, and perhaps most importantly – technical analysis is a lot more important in the forex scene in comparison to its fundamental counterpart. As such, you need to understand how to perform in-depth research on the currency in order to evaluate which way its price is likely to move in both the short and long run. Crucially, this centres on two types of research methods – fundamental and technical research. By this point in our guide, you should now have a firm understanding of how forex trading works and what you need to do to make a profit. As such, any licensed forex broker that accepts UK or European traders must abide by the above limitations.

Where can I trade currencies on the forex market?

Traders use the same theory to set up their algorithms however, without the manual execution of the trader. Trend trading can be reasonably labour intensive with many variables to consider. The list of pros and cons may assist you in identifying if trend wholly owned subsidiary example trading is for you. For example, the amount that you stake, whether or not you apply leverage, how actively you trade, and of course – what your win/loss ratio amounts to. It’s probably a good idea to stick with one strategy if you are just starting out.

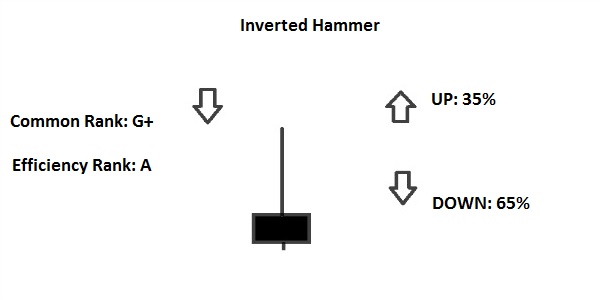

At the top is resistance (Senkou Span A) and at the bottom is support (Senkou Span B). It’s beyond the scope of this article to cover in-depth all the different candlesticks. In the below example, GBPUSD has increased in value and met a long-term resistance line. These regular gatherings involve discussion of monetary policy, interest rates, inflation, and other issues that affect currency valuations. When it comes to the speed we execute your trades, no expense is spared.

How Big Is The Forex Market?

In order to make money, traders will need to speculate correctly on whether the currency pair will rise or fall in value. Sometimes the market breaks out of a range and move below the support or above the resistance, setting off a trend. This happens naturally when support collapses and the market plunges into new lows, where buyers begin to hold off as they wait for a bottom to be reached. Meanwhile, some traders resort to panic selling or force out of their positions or build short positions because they believe it can go lower.

- Pip is an acronym for “percentage in point” or “price interest point.” A pip is the smallest price move that an exchange rate can make based on forex market convention.

- This strategy consists of looking at a price chart and finding the so-called resistance and support lines.

- One way to learn to trade forex is to open up a demo account and try it out.

- Forex markets operate on a 24/5 basis but the principle of day trading has carried over to the currency markets.

- They might also use longer and shorter term moving averages and watch for crossovers to signal a potential reversal.

You can observe the dollar index (DXY) reversing its trend direction on a weekly chart below. Scheduled events e.g. economic statistics, interest rates, GDPs, elections etc., tend to have a strong impact on the market. Take profit is also 5 pips as we focus on achieving a large number of successful trades with smaller profits. Therefore, in total 20 pips were collected with a scalping trading strategy. If you want to invest occasionally, day trading is not for you—but if you want to make forex your job, this can be the strategy you’ve been looking for. Day traders open and close all their positions during the same trading day—nothing is left to sit overnight.

On the vertical axis is ‘Risk-Reward Ratio’ with strategies at the top of the graph having higher reward for the risk taken on each trade. Position trading typically is the strategy with the highest risk reward ratio. On the horizontal axis is time investment that represents how much time is required https://1investing.in/ to actively monitor the trades. The strategy that demands the most in terms of your time resource is scalp trading due to the high frequency of trades being placed on a regular basis. If you want to succeed in this space, then you need to dedicate countless hours learning your trade.

Once you’ve set everything up, learned your strategies, and practiced a bit on the demo account, it’s time for the real deal. Analyze the markets to find a good opportunity, open a trade, and set stop and limit orders. This is a great way to learn how the platform works and see if your analytical ability is providing results.

Also, to enjoy your trading strategy, you should create positive trading habits. From a healthy lifestyle to engaging hobbies, one has to build a healthy plan that can enhance their trading routines. Though there are no one-size-fits-all strategies in forex, we at Trading Education can help you explore different strategic moves. Here are some key forex strategies suitable for beginners in the world of forex. There several strategies experts are using for performing their trade business on the forex network. We will discuss them in the below section to provide you an understanding to make the trading techniques easier for you.

Carry trade

While some forex trading signals may be available online, experienced traders may also develop trading strategies. Pick a few currency pairs and notice how many opportunities exist for making exceptional profits. Yes, you pay fees for holding the trade, but they are minuscule compared to the profit potential. So with a 50% chance of being right, it should be easy to make money from trading Forex. But the truth is there’s a 95% failure rate for Forex traders, and this percentage never seems to improve.

Best Gold Trading Strategies – Benzinga

Best Gold Trading Strategies.

Posted: Sat, 26 Aug 2023 00:29:41 GMT [source]

However, we would strongly suggest that you start off with a day trading simulator. These are essentially demo accounts offered by online brokers and they allow you to trade in live currency market conditions without risking any money. A position trading strategy identifies potential entry and exit levels in the market. This is done by a combination of technical indicator data and fundamental analysis. As a result, traders that use a position trading strategy don’t need to worry about minor price fluctuations or pullbacks. Instead, they occasionally monitor trends to have a holistic view of the market.

Find out what Influences Currency Prices ?

You can make this up multiple times of the day because it will be helpful for you to make more profit in a day. Swing trading strategy is one of the best strategy experts are using to trade on the forex trading network. In that strategy, traders can quickly take advantage of real-time market trends and rang bound to get the most profit from their trading.

Use the pros and cons below to align your goals as a trader and how much resources you have. In turn, this means that you are effectively borrowing the funds from the broker – even if you do not apply leverage per-say. As such, you will need to pay a small amount of interest for each day that you keep the forex trade open. This is known as overnight financing – although some also refer to it as swap or rollover-fees.

Below we list some of the most widely used strategies in the forex trading scene. An additional option that you might want to consider as a newbie forex trader is that of ‘copy trading’. This is a feature offered by several platforms in the online space – albeit, eToro is the preferred option.

The truth is that the forex market can be unpredictable and losing is a normal part of the game. If you want to make a profit, invest in realistic expectations, trading education, and consistency instead. Numerous forex trading techniques and tactics exist, which can surely confuse newbies. The only way to prevent that from happening is by employing a successful trading strategy for beginners. We all know that the forex market is highly popular and appealing among individuals of all backgrounds, right?

Since carry trades usually involve leverage, they have the potential to be very risky. This means that profits can be small but also substantial, it all depends. This strategy consists of looking at a price chart and finding the so-called resistance and support lines.

Bollinger Bounce Strategy

When it comes to high volumes, figures show that every day in the world of investing, there is at least one stock that can move up to 30%. Here forex news releases play a crucial role, so always keep an eye on different trading announcements and market news. If you learn how to draw proper trend lines on your own charts, this might increase your chances of making a successful trade. So do not hesitate to employ this effective strategy in your trading ventures as a beginner trader. Here we should note that market trends are usually long-, medium-, or short-term. So you will have to decide if you want a long-term or a short-term strategy, which in turn will give you an idea of what type of data and charts to use.

With support and resistance levels, traders can create a bracketed trading range. Position trading is a strategy used over longer time frames that is focused on the fundamentals that influence cyclical trends. In addition, position traders often focus on long-term technical indicator data such as monetary policies, political events, and other factors that affect FX trends. Also, trading styles allow you to determine how much time you dedicate to trading.

The two principal fundaments of the forex market analysis are fundamental analysis and technical analysis. When taking a look at the forex quotes you will note the two different prices listed there that are available for each currency pair. The ask price is basically the price at which you can buy the currency. The bid price, on another hand, is the price at which you can sell the currency.

Without effective forex strategies, you are likely going to enter trades instinctively and lose money. No trading strategy works 100% of the time because the Forex market is reactive to economic news, order flow, and global issues. For instance, when the Covid-19 pandemic began impacting society, the Forex market reacted accordingly. A forex trading strategy is a systematic approach that traders use to determine when to buy or sell a tradable instrument. A well-crafted strategy includes both entry and exit parameters, which helps eliminate guesswork from the trading process. Because swing trading is a short-term strategy, traders only need to focus on price analysis rather than long-term macroeconomic trends and important global developments.