Contents:

In the following table, we show all the transactions that have been recorded. The sum of credits in the current account is the $1,000 computer. The sum of debits in the current account is the $1,000 camera. On the financial account there are two credit entries of $1,000, one representing U.S. currency and the other representing Japanese currency.

No matter the size of a company and no matter the product a company sells, the fundamental accounting entries remain the same. Printing Plus provided the service, thus earning revenue. On January 18, 2019, paid in full, with cash, for the equipment purchase on January 5. On January 9, 2019, receives $4,000 cash in advance from a customer for services not yet rendered. On January 3, 2019, issues $20,000 shares of common stock for cash.

Double-entry Bookkeeping of Accounting Transactions

Cash was used to pay the utility bill, which means cash is decreasing. This is a transaction that needs to be recorded, as Printing Plus has received money, and the stockholders have invested in the firm. On January 23, 2019, received cash payment in full from the customer on the January 10 transaction. On January 5, 2019, purchases equipment on account for $3,500, payment due within the month. Journaling the entry is the second step in the accounting cycle.

The account title should be logical to help the accountant group similar transactions into the same account. Once you give an account a title, you must use that same title throughout the accounting records. The account title will appear above the horizontal line, and debits and credits will appear to the left and right of the vertical line, respectively. Gift cards have become an important topic for managers of any company. Understanding who buys gift cards, why, and when can be important in business planning. Also, knowing when and how to determine that a gift card will not likely be redeemed will affect both the company’s balance sheet and the income statement .

Our solutions for regulated financial departments and institutions help customers meet their obligations to external regulators. We specialize in unifying and optimizing processes to deliver a real-time and accurate view of your financial position. Enabling tax and accounting professionals and businesses of all sizes drive productivity, navigate change, and deliver better outcomes. With workflows optimized by technology and guided by deep domain expertise, we help organizations grow, manage, and protect their businesses and their client’s businesses. The capital account is recorded on the credit side to indicate that capital has increased. The owner starts the business with £5,000 paid into a business bank account on 1 July 20X2.

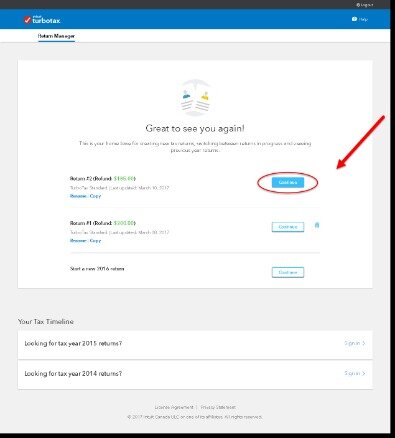

Delete transactions

Three, all capital accounts have credit balance brought down (CR bal b/d). The double entry principle always applies whether the transaction effect assume to . That is; for every DEBIT entry, there must be a corresponding CREDIT entry in the respective account affected and the vice versa is true.

The special journals that we will illustrate are examples of those found in many manually kept books, but they are not the only types used. Many firms design their specialized journals to meet their particular needs. Special journals are only required for frequent or repetitive transactions. For example, a business concern has many transactions in which cash is received and many in which cash is paid out. While few entrepreneurs start their own businesses because they’re fond of paperwork, recording your day-to-day sales, purchases and other transactions is a must. These are everyday transactions that keep the business running, such as sales and purchases, rent for office space, advertisements, and other expenses.

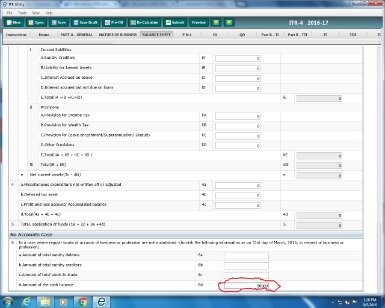

Summary Statistics (after Steps 1, 2, and 3a)

In the last column of the Cash ledger account is the running balance. This shows where the account stands after each transaction, as well as the final balance in the account. How do we know on which side, debit or credit, to input each of these balances? Printing Plus provided the services, which means the company can recognize revenue as earned in the Service Revenue account. Service Revenue increases equity; therefore, Service Revenue increases on the credit side. The company provided service to the client; therefore, the company may recognize the revenue as earned , which increases revenue.

The next set of payroll transactions you’ll record will be simpler, notating how much your employee wages are after payroll tax deductions. Rebekiah received her BBA from Georgia Southwestern State University and her MSM from Troy University. She has experience teaching math to middle school students as well as teaching accounting at the college level. She has a combined total of twelve years of experience working in the accounting and finance fields. An entity may both make and receive payments by any of these methods. 1 August BKW bought cake tins priced at $500 from Mr KNP.

When a country has a current account surplus, it must have a financial account deficit of equal value. And when a country has balanced trade , then it must have balance on its financial account. The transaction involves an exchange of currency for currency.

Real estate transactions in Polk, Dallas counties – Business Record

Real estate transactions in Polk, Dallas counties.

Posted: Wed, 12 Apr 2023 12:52:44 GMT [source]

For example, let’s say that you just invoiced a customer for $208. For example, let’s say your business receives a bill for $75 for office cleaning that is due at the end of the month. You would record the expense in the appropriate month and record the amount due in accounts payable. State the journal entries required to record each of the transactions. All payments out of the bank account should be authorised by a senior member of staff. Two signatories may be required for amounts above a specified value, e.

2.2 Recording transactions using T-accounts

The difference between the debit and credit totals is $24,800 (32,300 – 7,500). Having a debit balance in the Cash account is the normal balance for that account. Accounts Receivable was originally used to recognize the future customer payment; now that the customer has paid in full, Accounts Receivable will decrease. Accounts Receivable is an asset, and assets decrease on the credit side.

The total of all debits always equals the total of all credits for any given transaction. The accountant makes the debits on the left side of the ledger and the credits on the right side. These credits and debits result in either decreases or increases in accounts depending on what types of accounts the transaction impacts. The double-sided journal entry comprises two equal and corresponding sides, known as a debit and a credit . It will ensure that total debits will always equal total credits. The journal entry is the most basic form of recording a transaction, in which the accountant manually enters the account numbers, debits and credits for each individual transaction.

Cornerstone International Alliance: Sets new record: $1.3 billion in … – Wisbusiness.com

Cornerstone International Alliance: Sets new record: $1.3 billion in ….

Posted: Fri, 14 Apr 2023 09:13:06 GMT [source]

At the end of the business day, record your cash register totals in the sales journal. If you have employees, your chosen software should permit the use of passwords to control access to all or some of your accounting transactions. In order to prevent irregularities by your employees or others, it’s wise to restrict access to your accounting records.

However, for some time, it will be common for individuals to use the term “capital account” to refer to the present “financial account.” So be warned. The accounting cycle also provides a handy reminder of the necessary steps that need to be followed, which can be beneficial for those new to the accounting process. There are a few steps in the general process of recording transactions. First, an accountant must determine the accounts the transaction impacts. Second, the accountant must decide if the accounts will be debited or credited. Finally, the accountant makes entries in the journal with the date of their occurrence, and then they are posted or transferred to the ledger.

- This journal should record non-routine transactions, and many of these transactions should be approved by the head of the accounting department or by someone with similar authority.

- You will notice that the transactions from January 3 and January 9 are listed already in this T-account.

- Do not rename records to standard NetSuite record types or reuse the same name for multiple record types.

- Maintenance of the sales and purchase ledgers, along with their reconciliation and agreement with the appropriate control account total, is dealt with in a subsequent chapter of this publication.

The recording of transactions in a journal must occur before they can be posted to the ledger and, ultimately, the financial statements. The principles of recording accounting transactions in day books, and their use for recording information in the ledger accounts, is introduced in this chapter. General journals record all transactions, whether routine or non-routine.

If your accountant knows the software you’ve chosen, he or she will probably help you set it up. A new blank transaction is waiting to create a new entry by default. If needed, click the button above transactions area or press Command-N to create a new transaction. These are transactions that don’t involve a sale or purchase but may involve donations and social responsibility. They don’t involve any sales but rather other processes within the organization. This may include computing the salary of the employees and estimating the depreciation value of a certain asset.

The date of each transaction related to this account is included, a possible description of the transaction, and a reference number if available. There are debit and credit columns, storing the financial figures for each transaction, and a balance column that keeps a running total of the balance in the account after every transaction. Lynn asked to be sent a bill for payment at a future date. This creates a liability for Printing Plus, who owes the supplier money for the equipment. This liability is increasing, as the company now owes money to the supplier.

Accounts Receivable is an asset, and assets increase on the debit side. Dividends distribution occurred, which increases the Dividends account. Dividends is a part of stockholder’s equity and is recorded on the debit side. This debit entry has the effect of reducing stockholder’s equity. Paying a utility bill creates an expense for the company.

You can easily change the name of the account depending on what is purchased – it could be inventory, office supplies, packaging for goods or social media advertising. As you can see – the equation balances because the net change in assets is $0, which matches the $0 change in liabilities and equity. All business transactions must be recorded to the proper journal by double-entry book keeping.

Three Deals ‘Emblematic’ of Market During Record Q1 for Crypto M&A – Blockworks

Three Deals ‘Emblematic’ of Market During Record Q1 for Crypto M&A.

Posted: Tue, 18 Apr 2023 21:16:30 GMT [source]

1 August Mr KNP purchased equipment at a cost of $2,000 from wholesalers TPL. 2 August Mr KNP returned goods costing $150 to another supplier, ICO. 5 August Mr KNP purchased baking trays at a cost of $600 from regular supplier TTI. 8 August Mr KNP purchased ovens costing $10,000 from HSL.

You will notice that the transactions from January 3, January 9, and January 12 are listed already in this T-account. The next transaction figure of $100 is added directly below the January 12 record on the credit side. Might purchase food items in one large quantity at the beginning of each month, payable by the end of the month. Therefore, it might only have a few accounts payable and inventory journal entries each month.

- This may include computing the salary of the employees and estimating the depreciation value of a certain asset.

- You are now paying down some of the money you owe on that account.

- Every transaction between a domestic and foreign resident can be recorded as a debit and credit entry of equal value on the balance of payments accounts.

- The bank clearing system passes it to the drawer’s bank for approval and payment, with the result that it is taken out of the drawer’s bank account.

- This day book does not include cash sales which are recorded in the cash book.

The story and logic are partially correct but incomplete. The logic of the argument focuses exclusively on trade in goods and services but ignores trade in assets. Thus it is true that when imports of goods exceed exports, we are buying more foreign goods and services than foreigners are buying of ours. However, at the same time, a current account deficit implies a financial account surplus.

On the bookkeeping boston Names subtab of the Rename Records/Transactions page, you can change the names and abbreviations of standard NetSuite transaction types. In the Name column, you can change the names of your accounts in NetSuite. Transaction abbreviations often show in lists of transactions, such as the Transactions subtab on relationship records, in the audit trail and on registers. Name changes are applied to standard NetSuite element names , but not to elements you have customized. In the example in step 3 of the following procedure, the standard entity record named “Customer” is renamed “Client”. In this account, you could also have a custom center tab named “Customer”.