Contents:

While a position trade may last several months or even years, and a swing trade several days up to a few weeks, a scalp trade’s duration is mere minutes, or even seconds. Clearly, this does not guarantee that all positions will succeed, however, this tactic might help traders to win the majority of the trades. This can be especially harmful, if some major announcement or event is taking place, since a trader can lose a significant amount of money, because of that. Choosing brokers with no dealing desk is also essential, since getting a refusal for opening or closing trades at the wrong time can prove very devastating for the trading account. The first option comes with high risk and breaks risk-management rules. If you’re prone to high risk and emotionally stable, your scalping will be profitable.

I would say the biggest advantage of scalp trading is having to learn it. Due to high-frequency trading, the day trader learns to better understand the principles of entering and exiting trades, the nature of the Forex market and learns to develop intuition. After mastering scalping that is far more complex, intraday and long-term strategies will seem easier.

References to https://forex-world.net/.com or GAIN Capital refer to GAIN Capital Holdings Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options. Scalping trading strategies can also be very stressful for some people.

Pairs in the middle of the chart, EUR/AUD for might not be the best option for the type of trades, but in some cases, they might be still useful. To get a better idea of what is scalping in Forex and, more precisely, how scalping in the Forex market works, let us go through them one by one. I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe. Warner or Monitoring Spread are indicators that show how spread bets increase and decrease online. They can be installed into MT4 as an indicator or a script, based on the version.

How many trades do scalpers execute per day?

If you look for a 5-Forex scalping strategy Forex scalping strategy on the Internet, it’s likely this will be the first one you will find. 2) Stochastics indicator with a period-setting of 5,3,3. The Stochastics indicator is an oscillator which signals overbought market conditions when its value crosses above 80, and oversold market conditions when its value crosses below 20. A long entry is confirmed only when the Stochastics indicator is below overbought conditions, while a short entry is confirmed only when the indicator is above oversold conditions. The Best Time Frame For Forex TradingA time frame is a designated time period where forex trading takes place.

Before we look at the trade setups, it is important to note that this strategy works best when trades are taken in the same direction as the main trend. Volatility is favourable when trading derivatives, as it allows traders to profit from rising and falling market prices. But it’s important to have a risk management strategy to minimise losses, especially when using leverage to open a position. Because scalping is most successful when markets are volatile, the best time to open a position is during the session’s open and close. Currency scalping is not much different from the CFTC’s definition.

Scalping vs day trading

The problem can be partially solved by scripts and trading robots. Even if you set your profit target at three points, wait for the trend to complete its movement. Don’t try opening many trades in different complex instruments at the same time. Open a trade on a candlestick that observes both conditions. If the gap between the two conditions equals one candlestick, you can open a trade, but such a signal is considered as lagging.

Once the above conditions are met, enter a long position as soon as the Stochastic Oscillator lines cross above the horizontal 20-level line. Select a forex pair that is most active during a particular trading session and has a tight spread. When the standard deviations widen, traders refer to it as a ‘Bollinger bounce’ – which is taken to be indicative of an upcoming retracement.

- Plot Fibonacci correction levels at the beginning of the trend.

- Scalping in stock liquid markets is high-frequency trading in stocks, futures, and other derivatives.

- When a market sees a protracted move in a given direction, a trend can be ascertained.

- For this trading approach, we will add the RSI indicator.

- These indicators will help you make your scalping strategy with better confidence.

In the below 5-minute chart, see how price moves above both the 8-period and 34-period exponential moving average . Also, the shorter period EMA crosses above the longer period EMA, suggesting a potential uptrend. Scalp trading is a very short-term strategy that involves taking lots of small profits each day. Scalpers will open and close multiple positions each session – with some trading every few minutes or even seconds as they hunt for opportunities. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S.

Signals appear almost every day, so you may trade no more than one or two currency Forex pairs. If you have managed to pick up the start of the trend, the target profit size can be increased. This scalping strategy does not produce signals frequently.

What you want to look for first is if the volume indicator is showing you any trend, reversal, or stagnant price action. If the volume indicator increases, so will the price action. This is because there is a plethora of interest in that currency pair. We feel it works best with the 5 minute and 15 minute time chart. This ultimate 1 minutes scalping strategy can take on dozens of trades per day.

Top Indicators for a Scalping Trading Strategy

When a market sees a protracted move in a given direction, a trend can be ascertained. A downtrend will see a series of lower lows and lower highs, while an uptrend will see higher lows and higher highs. The broader trend can be a useful barometer of potential price action on a shorter scalping timeframe. Let’s assume that your average pip value is about $10.

What Is SMC (Smart Money Concepts) Forex Strategy? – EarnForex News

What Is SMC (Smart Money Concepts) Forex Strategy?.

Posted: Tue, 31 Jan 2023 09:24:07 GMT [source]

With Forex Scalping Strategy, you should aim for 5-10 pips from every single position you hold. Opportunities to leverage from small changes in the price. We wait for the candlestick to touch the 8-period EMA by its high. A buy order is placed at the high of this candlestick.

Scalp trading using the RSI

Today, trading volumes are taken into account in the analysis – as are the opening and closing prices and the high and low of the candle. Usually, the volumes are painted in the color of the candle, but you should not pay attention to this because it does not say anything about how the buyers and sellers behaved inside the candle. Volumes of Forex transactions are calculated by the number of trades – without taking into account the funds expended on each of these trades.

Should you trade exotic currency pairs? – FXCM

Should you trade exotic currency pairs?.

Posted: Thu, 06 Oct 2022 07:00:00 GMT [source]

Another important component for success in this field is choosing currency pairs with higher volatility. This essentially can provide traders with more trading opportunities. In most cases, scalping is allowed in foreign exchange and Forex markets in general. For example, there are some categories of professional traders that aren’t allowed to scalp trade in the US in order to reduce high risks and avoid losing trades. It’s a trading system where trades are opened for a short period, up to a few minutes.

How to scalp in forex as a beginner

These include a mix of major and minor currency pairs such as the EUR/USD, GBP/USD and EUR/JPY. Forex scalping strategies are quite popular with beginner day traders. High-frequency trading allows taking quick real-time profits and avoiding swaps. Training on Forex scalping on a demo-account helps a newbie improve reaction and learn to intuitively understand the behavior of many traders in financial currency markets. However, one had better enter real trades on longer time frames.

Smaller moves happen more frequently than larger ones, even in relatively calm markets. This means that there are many small movements from which a scalper can benefit. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. Learn how to trade forex in a fun and easy-to-understand format. In order to be successful with scalping, pay attention to these four cornerstones of strategy.

One-minute scalping strategy

Get tight spreads, no hidden fees, access to 10,000+ instruments and more. A live account will automatically grant you access to a demo account first, where you can practise with £10,000 worth of virtual funds. Consult our money and risk management guide for more advice. Get tight spreads, no hidden fees and access to 10,000+ instruments.

- Click the ‘Open account’button on our website and proceed to the Personal Area.

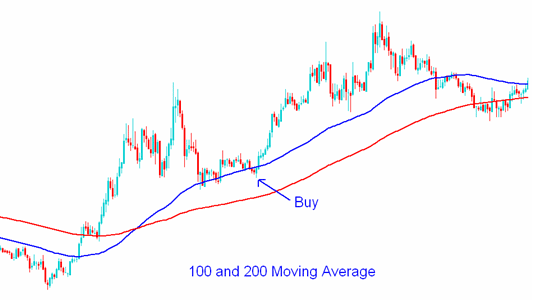

- A good scalping strategy with moving averages is the 9 and 30 EMA trading strategy.

- To do that, we open the H1 chart and insert 8- and 21- EMA.

- Choose the most active trading period concerning your tool.

- The system allows you to trade by yourself or copy successful traders from all across the globe.

The aim is for a successful trading strategy through the large number of winners, rather than a few successful trades with large winning sizes. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Using such compressed time frames, it’s not uncommon for an FX scalper to execute dozens of buys and sells each trading session.

The indicator is a series of dots placed above or below the price bars. A dot below the price is bullish, and one above is bearish. It is important to remember that these trades go with the trend, and that we are not looking to try and catch every move.

Someone is satisfied with the MT4 standard Forex scalping indicators, and someone installs unique author’s tools. Your trading style performance depends not so much on the tools as on the ability to use them. Fully automated trading Forex scalp advisor without Martingale elements.